CSS Accountancy & Auditing Past Paper 2020

Paper-I (Subjective) 80 Marks

Attempt ONLY FOUR questions from Paper-I PART-II by selecting TWO questions from EACH SECTION. (20×4)

SECTION – I

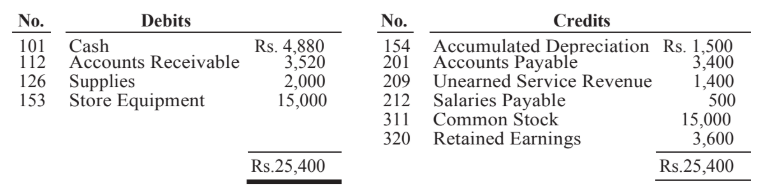

Q. 2. On September 1,2011, the account balances of R and Equipment Repair, Inc. were as follows.

During September the following summary transactions were completed.

Sept. 8 PaidRs.1,400 for salaries due employees, of which Rs.900 is for September.

10 Received Rs.1,200 cash from customers on account.

12 Received Rs.3,400 cash for services performed in September.

15 Purchased store equipment on account Rs.3,000.

17 Purchased supplies on account Rs.1,200.

20 Paid creditors Rs.4,500 on account.

22 Paid September rent Rs.500.

25 Paid salaries Rs.1,250.

27 Performed services on account and billed customers for services provided Rs.1,500.

29 Received Rs.650 from customers for future service.

Adjustment data consist of:

Supplies on hand Rs.1,200. Accrued salaries payable Rs.400. Depreciation is Rs.100 per

month. Unearned service revenue of Rs.1,450 is earned.

Required

(a) Journalize the September transactions. Prepare a trial balance at September 30.

(b) Journalize and post adjusting entries. Prepare an adjusted trial balance.

(c) Prepare an income statement and a retained earnings statement for September and balance sheet at September 30.

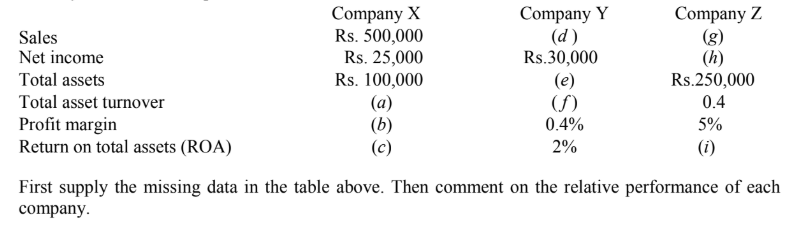

Q. 3. (A) Industry A has three companies whose income statements and balance sheets are summarized below.

(B) The Rivers Company reports the following data relative to accounts receivable:

Q. 4. (A) The Wessal Karim Corporation is considering installing a new conveyor for materials handling in a ware house. The conveyor will have an initial cost of Rs. 85,000 and an installation cost of Rs. 6,000. Expected benefits of the conveyor are: (a) Annual labor cost will be reduced by Rs. 17,000, and (b) breakage and other damages from handling will be reduced by Rs. 600 per month. Some of the firm’s costs are expected to increase as follows: (a) Electricity cost will rise by Rs.200 per month, and (b) annual repair and maintenance of the conveyor will amount to Rs.999. Assume the firm uses the MACRS rules for depreciation in the 5-year property class. No salvage value will be recognized for tax purposes. The conveyor has an expected useful life of 8 years and a projected salvage value of Rs. 4,500. The tax rate is 35 percent.

(a) Estimate future cash inflows for the proposed project.

(b) Determine the projects NPV at 10 percent. Should the firm buy the conveyor?

(B)

The Wessal Karim Corporation is considering installing a new conveyor for materials handling

in a ware house. The conveyor will have an initial cost of Rs. 85,000 and an installation cost of

Rs. 6,000. Expected benefits of the conveyor are: (a) Annual labor cost will be reduced by

Rs. 17,000, and (b) breakage and other damages from handling will be reduced by Rs. 600 per

month. Some of the firm’s costs are expected to increase as follows: (a) Electricity cost will

rise by Rs.200 per month, and (b) annual repair and maintenance of the conveyor will amount

to Rs.999. Assume the firm uses the MACRS rules for depreciation in the 5-year property

class. No salvage value will be recognized for tax purposes. The conveyor has an expected

useful life of 8 years and a projected salvage value of Rs. 4,500. The tax rate is 35 percent.

(a) Estimate future cash inflows for the proposed project.

(b) Determine the projects NPV at 10 percent. Should the firm buy the conveyor?

(B) Majid, Inc., accountants have developed the following data from the company’s accounting

records for the year ended April 30, 2017:

a) Purchase of plant assets, Rs.59,400.

b) Cash receipt from issuance of notes payable, Rs.46,100.

c) Payments of notes payable, Rs.44,000.

d) Cash receipt from sale of plant assets, Rs.24,500.

e) Cash receipt of dividends, Rs.4,800.

f) Payments to suppliers, Rs.374,300.

g) Interest expense and payments, Rs.12,000.

h) Payments of salaries, Rs.88,000.

i) Income tax expense and payments, Rs.37,000.

j) Depreciation expense, Rs.59,900.

k) Collections from customers, Rs.605,500.

l) Payment of cash dividends, Rs.49,400.

m) Cash receipt from issuance of common stock, Rs.64,900.

n) Cash balance: April 30, 2016, Rs.40,000; April 30, 2017, Rs.121,700.

Required: Prepare Majid’s statement of cash flows for the year ended April 30, 2017. Use the direct method for cash flows from operating activities.

SECTION – II

Q. 5. (A) Modern Geezer Company has two departments. Factory overhead costs are applied based on

direct labour cost in Department A and machine hours in Department B. The following

information is available:

Required:

(A) Compute the budgeted factory overhead rate for Department A.

(B) Compute the budgeted factory overhead rate for Department B.

(C) What is the total overhead cost for Job #10?

(D) If Job #10 consists of 50 units of product, what is the unit cost of this job?

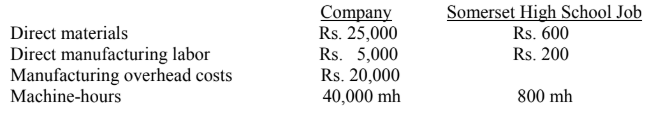

(B) Chief Manufacturing is a small textile manufacturer using machine-hours as the single indirect-

cost rate to allocate manufacturing overhead costs to the various jobs contracted during the year. The following estimates are provided for the coming year for the company and for the Somerset High School Science Olympiad Jacket job.

Required:

(a) For Chief Manufacturing, determine the annual manufacturing overhead cost-allocation rate.

(b) Determine the amount of manufacturing overhead costs allocated to the Somerset High School job.

(c) Determine the estimated total manufacturing costs for the Somerset High School job.

Q. 6. (A) Sodius Chemical Inc. placed 220,000 liters of direct materials into the mixing process. At the end of the month, 5,000 liters were still in process, 30% converted as to labor and factory overhead. All direct materials are placed in mixing at the beginning of the process and conversion costs occur evenly during the process. Sodius uses weighted-average costing.

Required:

(a) Determine the equivalent units in process for direct materials and conversion costs, assuming there was no beginning inventory.

(b) Determine the equivalent units in process for direct materials and conversion costs, assuming that 12,000 liters of chemicals were 40% complete prior to the addition of the 220,000 liters.

(B) Asghar Manufacturing Company sells its products for Rs.33 each. The current production level is 50,000 units, although only 40,000 units are anticipated to be sold.

Unit manufacturing costs are:

Direct materials ——— Rs. 6.00

Direct manufacturing labor ———– Rs. 9.00

Variable manufacturing costs———- Rs. 4.50

Total fixed manufacturing costs ———Rs.180,000

Marketing expenses ———- Rs.3.00 per unit, plus Rs.100,000 per year

Required:

(a) Prepare an income statement using absorption costing.

(b) Prepare an income statement using variable costing.

Q. 7. (A) Big Mind Corporation was recently formed to produce a semiconductor chip that forms an essential part of the personal computer manufactured by a major corporation. The direct materials are added at the start of the production process while conversion costs are added uniformly throughout the production process. June is Big Mind’s first month of operations, and therefore, there was no beginning inventory. Direct materials cost for the month totaled Rs.950,000, while conversion costs equaled Rs.4,625,000. Accounting records indicate that 475,000 chips were started in June and 425,000 chips were completed.

Ending inventory was 50% complete as to conversion costs.

Required:

(a) What is the total manufacturing cost per chip for June?

(b) Allocate the total costs between the completed chips and the chips in ending inventory.

(B) The following information was gathered for Smart-view Company for the year ended

December 31, 2018:

Assume that direct labor-hours are the cost-allocation base.

Required:

(a) Compute the budgeted factory overhead rate.

(b) Compute the factory overhead applied.

(c) Compute the amount of over/under applied overhead.

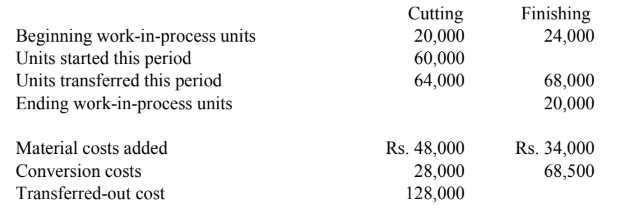

Q. 8. (A) Umar Company produces baseball bats and cricket paddles. It has two departments that rocess all products. During July, the beginning work in process in the cutting department was half completed as to conversion, and complete as to direct materials. The beginning inventory included Rs.40,000 for materials and Rs.60,000 for conversion costs. Ending work-in-process inventory in the cutting department was 40% complete. Direct materials are added at the beginning of the process.

Beginning work in process in the finishing department was 80% complete as to conversion. Direct materials for finishing the units are added near the end of the process. Beginning inventories included Rs.24,000 for transferred-in costs and Rs.28,000 for conversion costs. Ending inventory was 30% complete. Additional information about the two departments follows:

Required:

Prepare a production cost worksheet, using FIFO for the finishing department.

(B) During February the Luqman Manufacturing Company’s costing system reported several

variances that the production manager was surprised to see. Most of the company’s monthly

variances are under Rs.225, even though they may be either favorable or unfavorable. The

following information is for the manufacturing of garden gates, its only product:

1. Direct materials price variance, Rs.900 unfavorable.

2. Direct materials efficiency variance, Rs.1,900 favorable.

3. Direct manufacturing labor price variance, Rs.4,100 favorable.

4. Direct manufacturing labor efficiency variance, Rs.700 unfavorable.

Required:

(a) Provide the manager with some ideas as to what may have caused the price variances.

(b) What may have caused the efficiency variances?

Paper-II (Subjective) 80 Marks

Attempt ONLY FOUR questions from Paper-II PART-II by selecting at least ONE question from EACH SECTION. (20×4)

SECTION – I (AUDITING)

Q. 2. Why computerized audit is required in the presence of manual audit? Elaborate the

computerized auditing by application of Computer Assisted Audit Techniques (CAAT).

Q. 3. Define audit and auditing. Comment on the auditor’s (dependence) consideration of “reasonable

assurance” and “True & Fair view” for the financial audit of a corporate entity.

Q. 4. Write notes on any TWO of the followings:

(a) Audit materiality

(b) Misstatement and Fraud

(c) Test of Control and Substantive Procedures

SECTION – II (BUSINESS TAXATION)

Q. 5. Elaborate the following fundamental definitions/terminologies as defined under Section 2 of the

Income Tax Ordinance 2001.

(a) Heads of Income [Section 11]

(b) Tax Credits [Section 61 to 65]

(c) Capital Gains [Section 37 to 38]

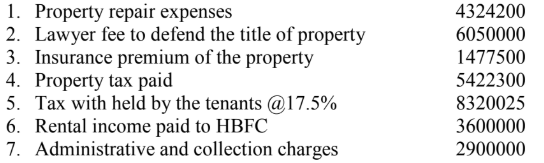

Q. 6. ABC (Pvt) Limited has earned income from business amounting to Rs. 75056000 during the tax

year 2019. It also has a plaza situated in Faisalabad. The rent receivable from plaza amounts

Rs. 47543000. Moreover, Company claims the following deductions (in Rs.):

Required: Calculate Total income and the Tax payable by the Company for the tax year 2019.

The company is a Non-filer.

SECTION – III (BUSINESS STUDIES AND FINANCE)

Q. 7. How many legal forms of Business Entity exist in Pakistan? Explain the features of Joint Stock Company and its procedure of formation (stages for formation of a Joint Stock Company-both Public limited and Private Limited companies).

Q. 8. XYZ Co. has Rs. 400 million in outstanding debt and Rs. 100 million in preferred stock. Its total value is Rs. 800 million. Its cost of debt (rd) is 8%, its cost of preferred stock is (rps) 9%, and its cost of common stock (rcs) is 12%. The firm has recently had numerous depreciation tax shields as well as low earnings. Consequently, it does not pay taxes.

What is its Weighted Average Cost of Capital (WACC) assuming it will continue to not pay taxes?